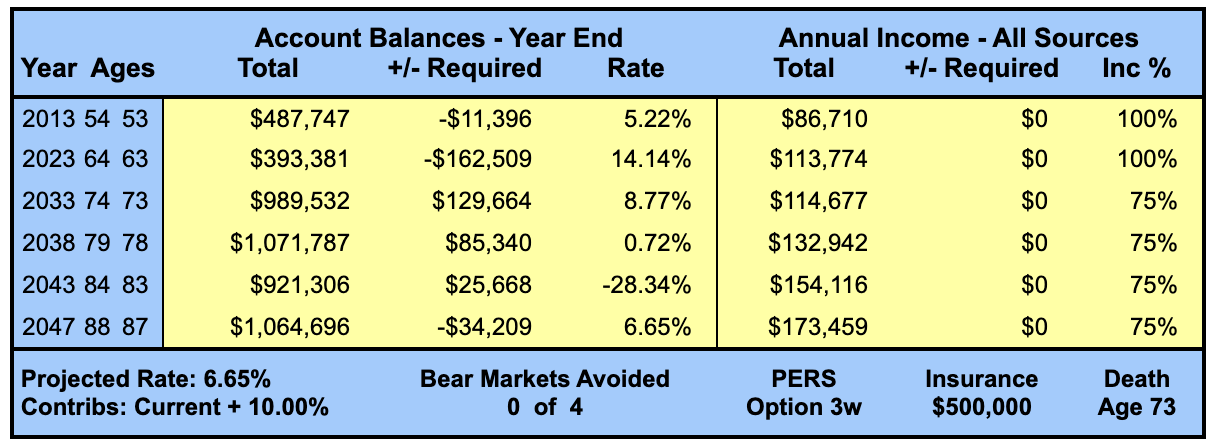

Main Scenario: “Worst Case” with Life Insurance (Richard: $500,000).

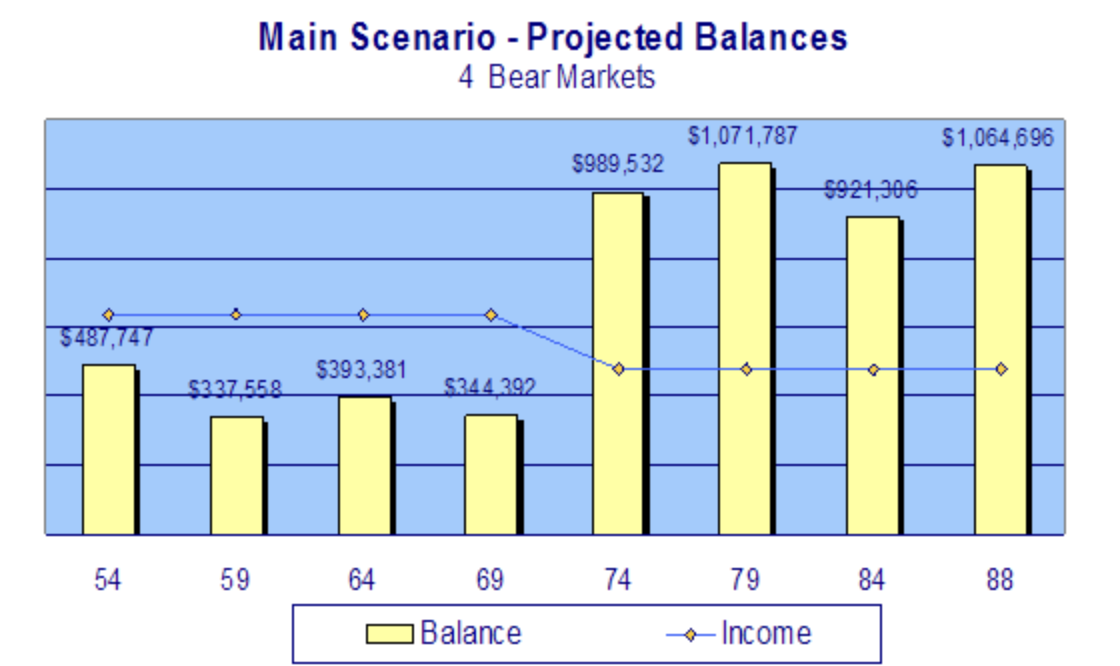

Here is the same “Worst Case” scenario, with ONE critical difference: to guard against Richard’s death (and the resulting loss of pension income), $500,000 of life insurance was combined with Option 3w. By age 87, Carol’s retirement accounts still hold $1,064,696 and ALL income requirements are being met.

Keep two important concepts in mind: (1) the $500,000 coverage will usually be sufficient regardless of Richard’s age at death, so long as the insurance proceeds achieve the projected 6.65% return. (2) Fear of investing (or the concern that income from insurance proceeds may be unreliable) must be faced squarely. At the time of Richard’s (hypothetical) death at age 73, your retirement accounts still hold $489,209 – a substantial investment responsibility whether or not life insurance is added to the mix.

Main Scenario: Projected Balances with Life Insurance (Richard: $500,000).