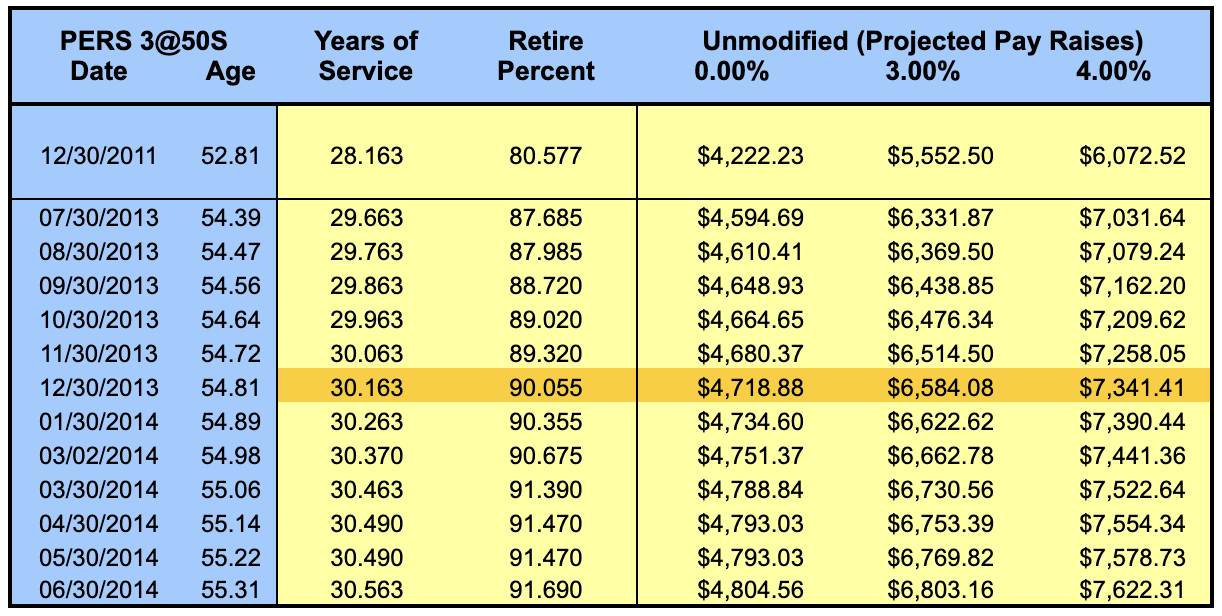

Date Comparison (Year Detail).

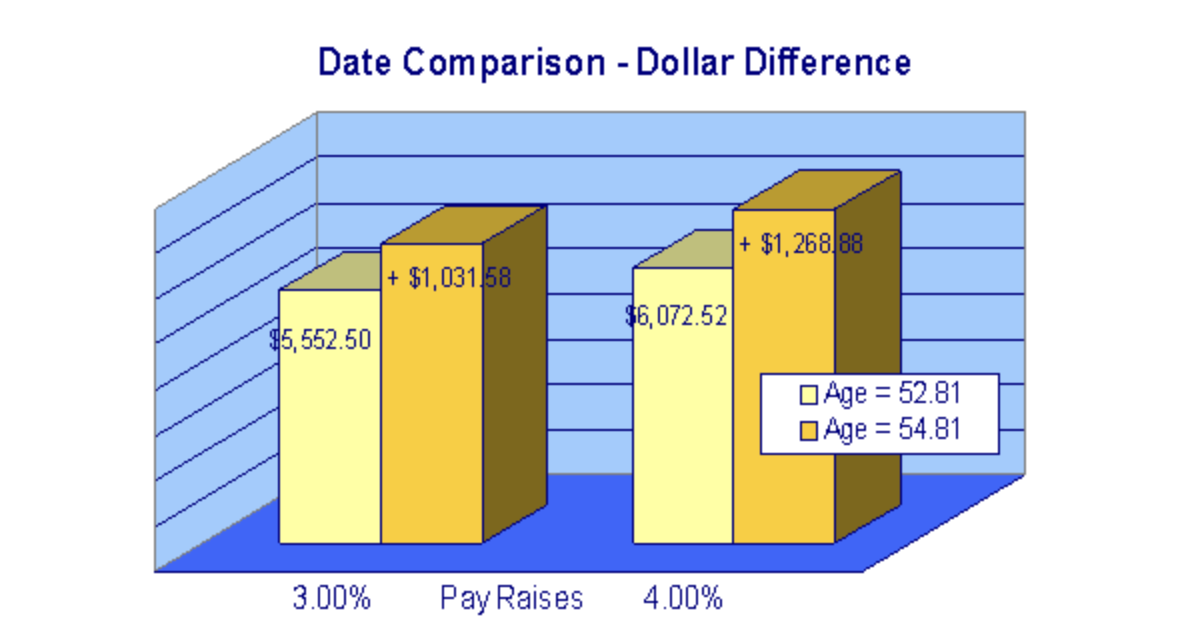

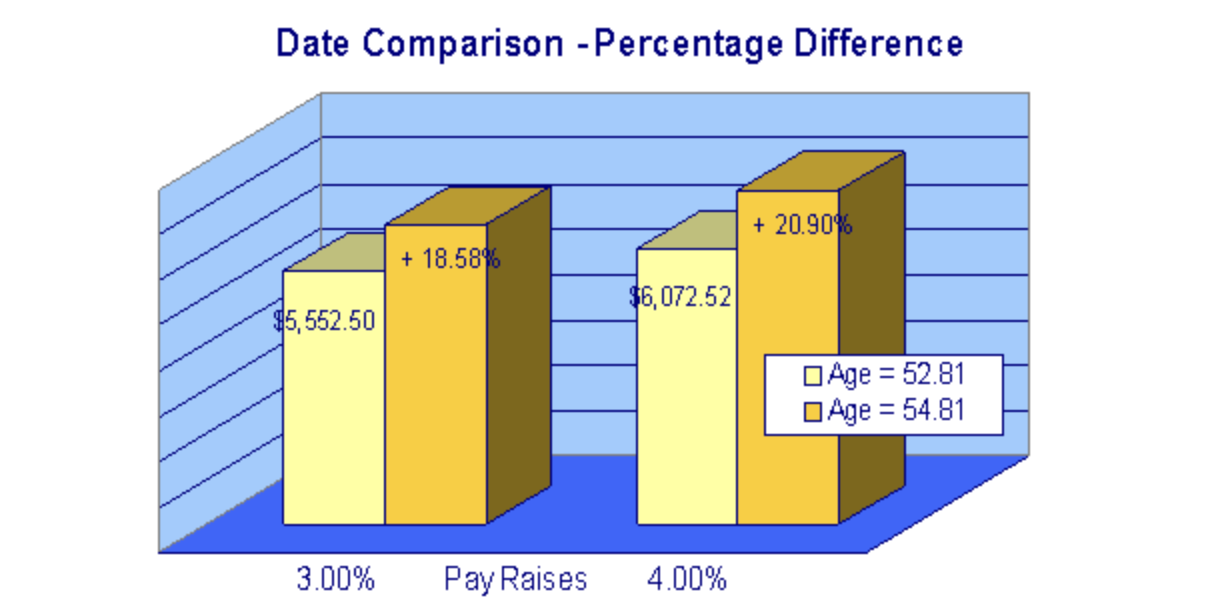

Here Richard is comparing dates 2.00 years apart, factoring in the PENSION PERCENT (based on Age and Years of Service) and the impact of PAY RAISES. If raises average 3.00%, retiring LATER will increase Richard's pension by $1,031.58 per month. But if raises average 4.00%, retiring later will increase the pension by $1,268.88 per month.

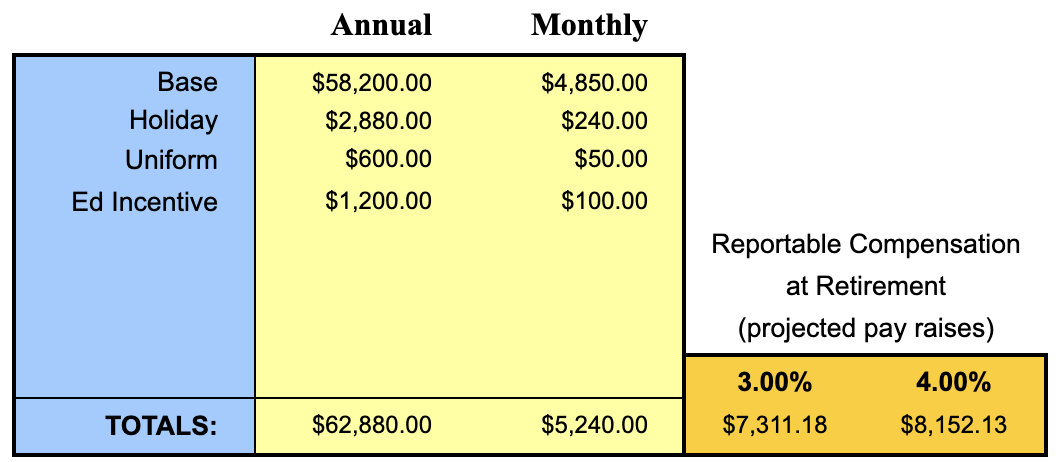

Reportable Compensation (Richard Sample - PERS).

Action Step: Target Retirement Date (Richard Sample).

Richard plans to retire on December 30, 2013 (age 54.81) with a pension of $6,584.08 (assuming projected pay raises of 3.00%). The pension is 90.055% of reportable compensation.

Richard plans to retire at age 54.81 (11.26 years from now). Compared to age 52.81, this will increase the pension by $1,031.58 per month (if pay raises average 3.00%).

Again you see the value of working 2.00 more years. Waiting until age 54.81 will increase the pension by 18.58% per month (if pay raises average 3.00%).