Main Scenario: Current Insurance Need (Richard: $344,000).

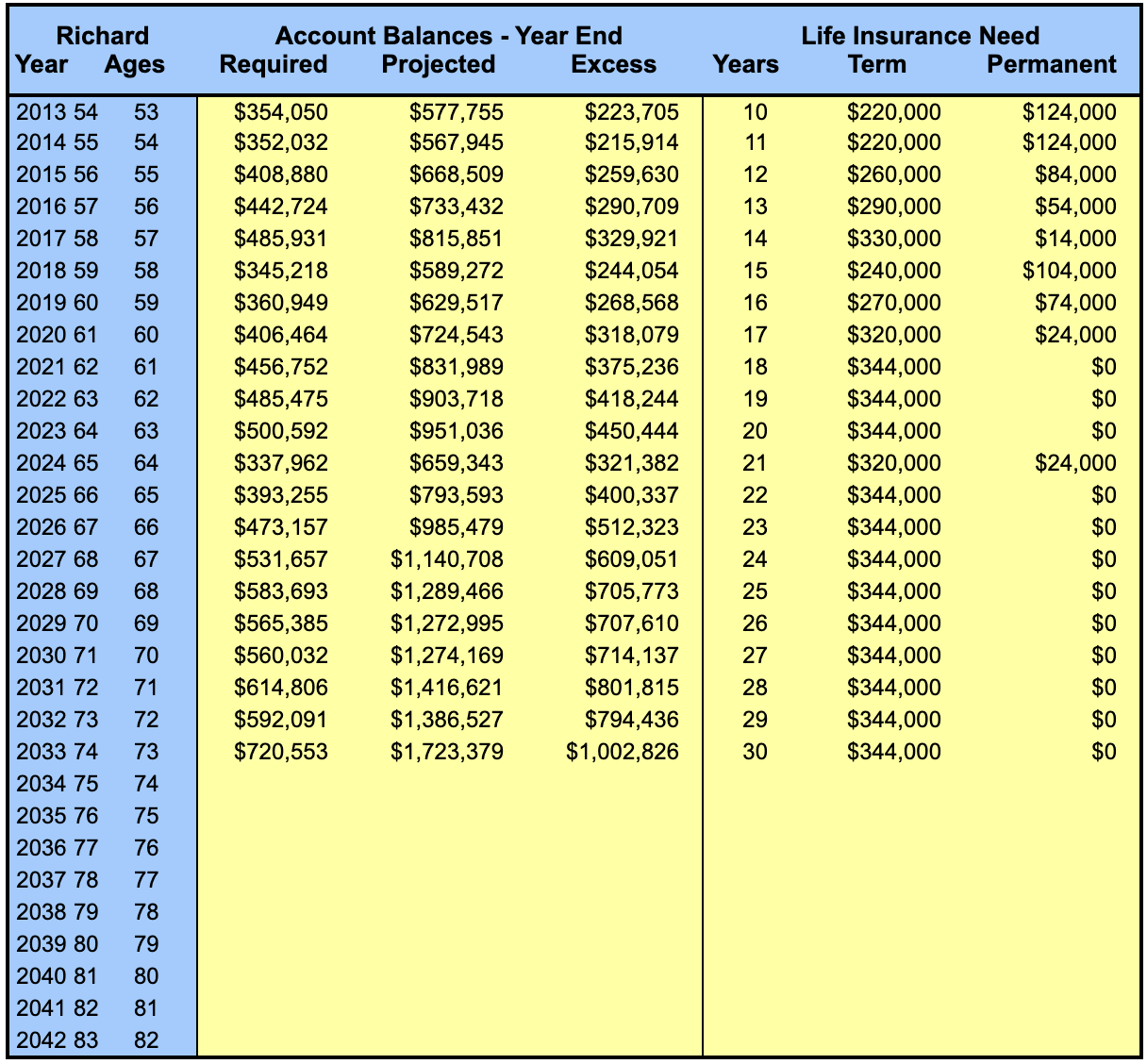

Richard has a current life insurance need of $344,000. But what TYPE of coverage should you have - Permanent or Term insurance? Begin with a basic premise: "Self-Insurance" is NOT the amount you've saved - it's the amount your savings EXCEED what your plans REQUIRE. To the extent you can REASONABLY expect to become self-insured, you eliminate the need for PERMANENT insurance. TERM insurance, covering the period of years between now and your self-insured point, will be sufficient.

Action Step: Protect Richard with 20-Year Term Insurance.

Based on your Self-Insured Analysis, Richard's optimal Life Insurance coverage is $344,000 of TERM insurance (20-Year). Make every effort to eliminate any GAPS in your protection.