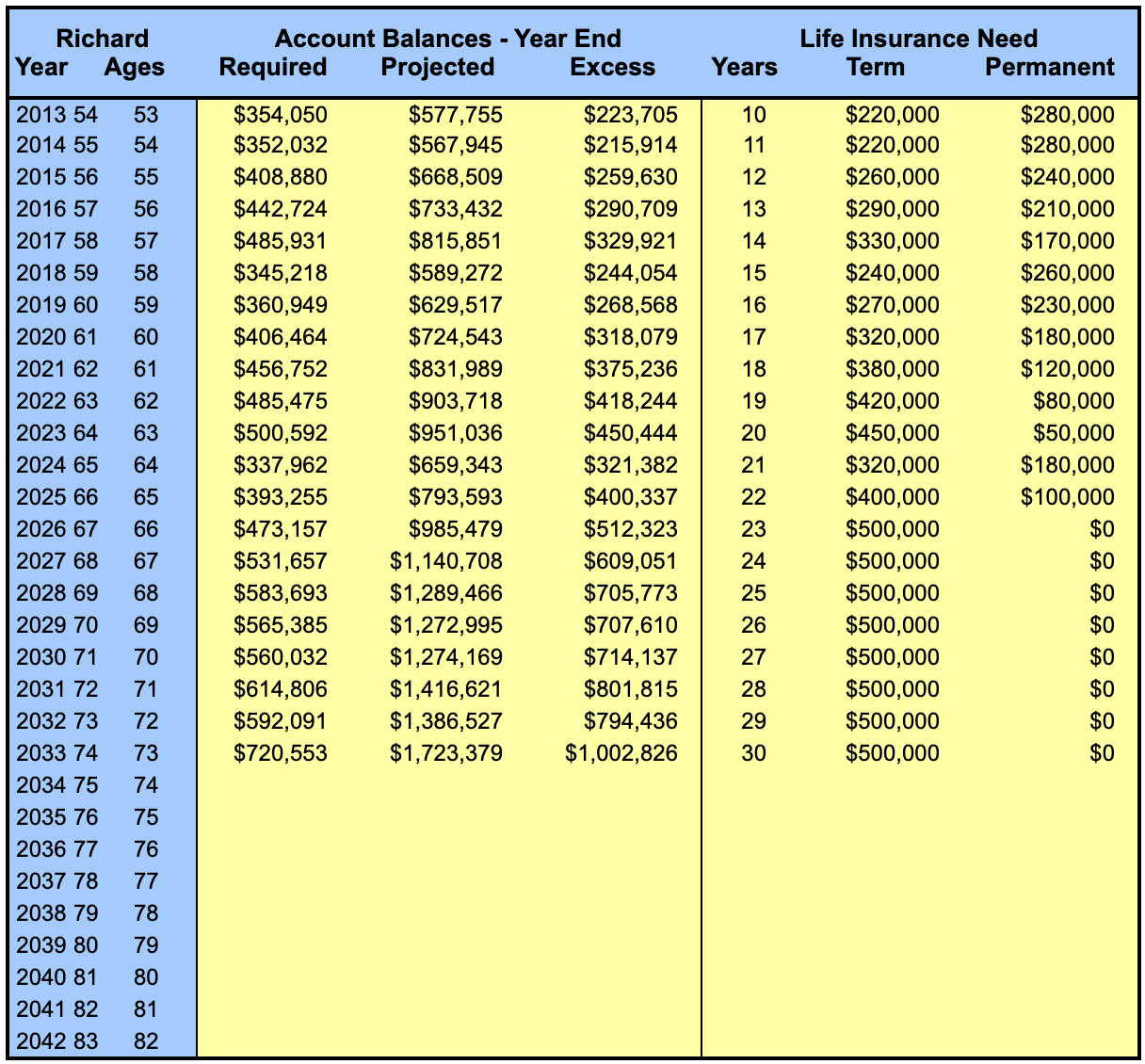

Main Scenario: Self-Insured Analysis (Richard: $500,000).

Protecting Richard's pension will require $500,000 of life insurance (when combined with OPTION 3W). But what TYPE of coverage should you have - Permanent or Term insurance?

Begin with a basic premise: "Self-Insurance" is NOT the amount you've saved - it's the amount your savings EXCEED what your plans REQUIRE. To the extent you can REASONABLY expect to become self-insured, you eliminate the need for PERMANENT insurance (and Survivor Options - which are another form of permanent insurance protection). TERM insurance, covering the period of years between now and your self-insured point, will be sufficient.

Based on your Self-Insured Analysis, Richard's optimal Life Insurance coverage is $500,000 of TERM insurance (30-Year).

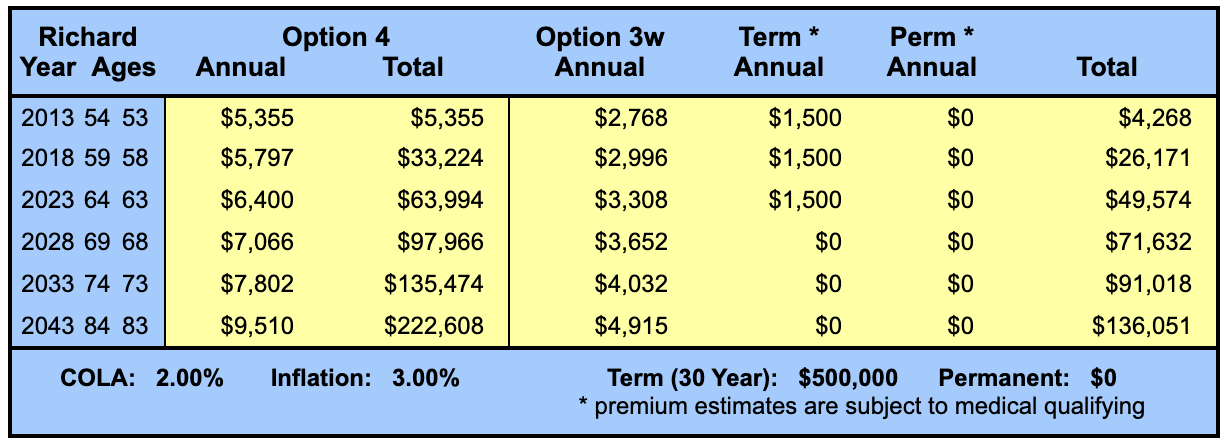

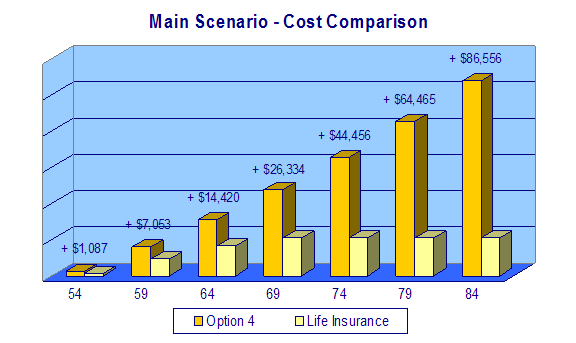

Main Scenario: Comparing Pension Protection Strategies

Main Scenario: Option 4 vs. Option 3w + Life Insurance.

Protecting Richard's pension requires a choice between two proven strategies: (1) using Survivor Options exclusively, OR (2) using a combination of Survivor Options and Life Insurance. Cost comparisons are important, especially when one strategy is substantially more expensive than the other. But understand the drawbacks of either choice: Survivor Options are irrevocable, inflexible, and rarely continue benefits to children. Life Insurance offers greater FLEXIBILITY and CONTROL, but how will the proceeds be invested? Will the income be reliable?