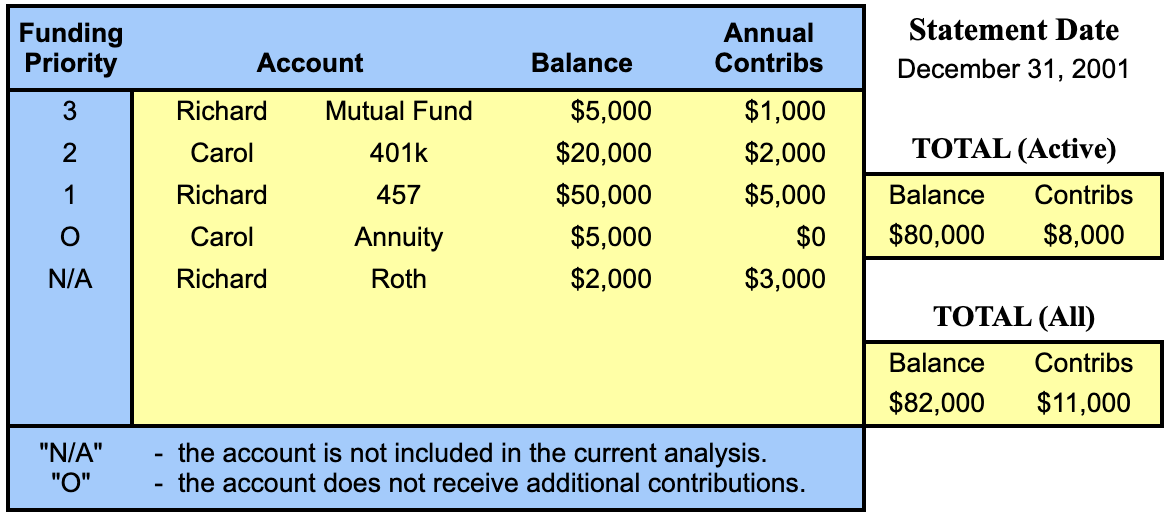

Active Retirement Accounts & Funding Priority (as of 12/31/2001).

Funding priority is based on the tax advantages and flexibility of specific savings plans. 457 Deferred Compensation and Roth IRAs rank the highest – and generally these plans should be funded FIRST until contribution limits are exceeded. “N/A” indicates the account has been set aside for purposes other than retirement – such as college education, gifting, or simply to increase your margin for error.

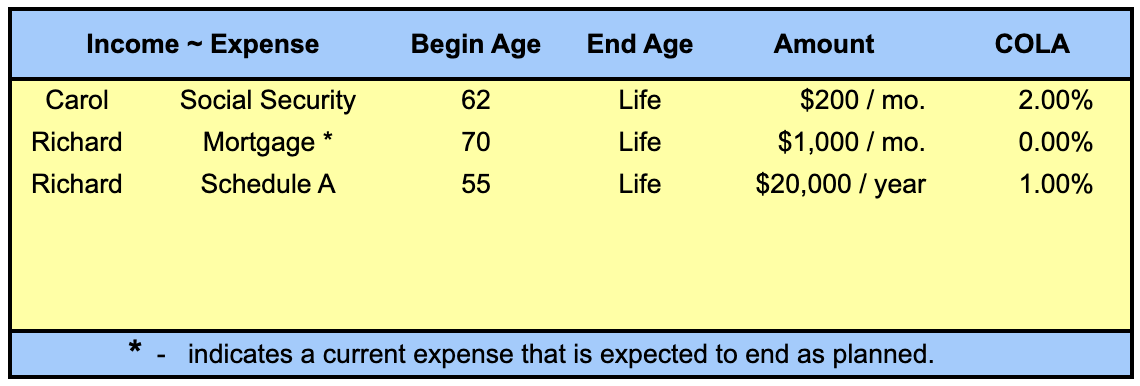

Post-Retirement Fixed Income ~ Expense Reduction ~ Tax Deductions.

Income listed here should have a high degree of certainty & reliability. Guaranteed payments such as Social Security or military pensions are good examples. Rental income should be included here but real estate equity would be listed above as an appreciating investment.

Some of your current expenses (such as mortgage payments, college education costs, etc.) will eventually come to an end. The effect this has on your planning, however, is not easily predictable. The elimination of these expenses may result in reduced spending and lower required income. Or you may decide to use the money for new “discretionary” reasons – such as travel, a new car, etc. Whenever major expenses come to an end, it’s an important moment to review your overall financial plan.

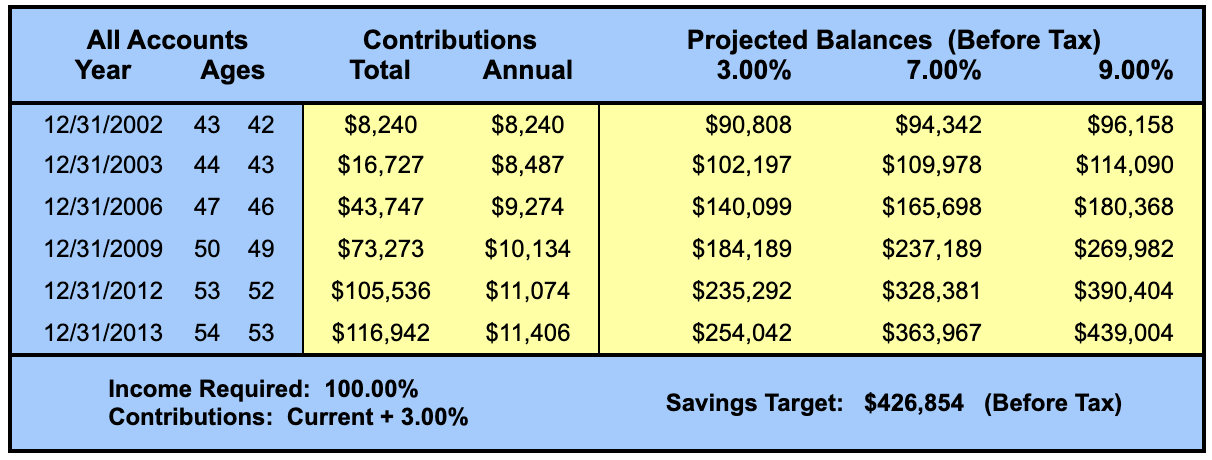

Main Scenario: If Contributions Increase 3% Each Year

Main Scenario: Projected Balances if Contributions Increase 3%.

To achieve your retirement goals, will your CURRENT investments, annual contributions and rates of return be sufficient? Assuming your investments average 7.00% and your contributions grow with pay raises (3% each year), your projected BEFORE TAX balance will be $363,967 by retirement - 85% of your target.

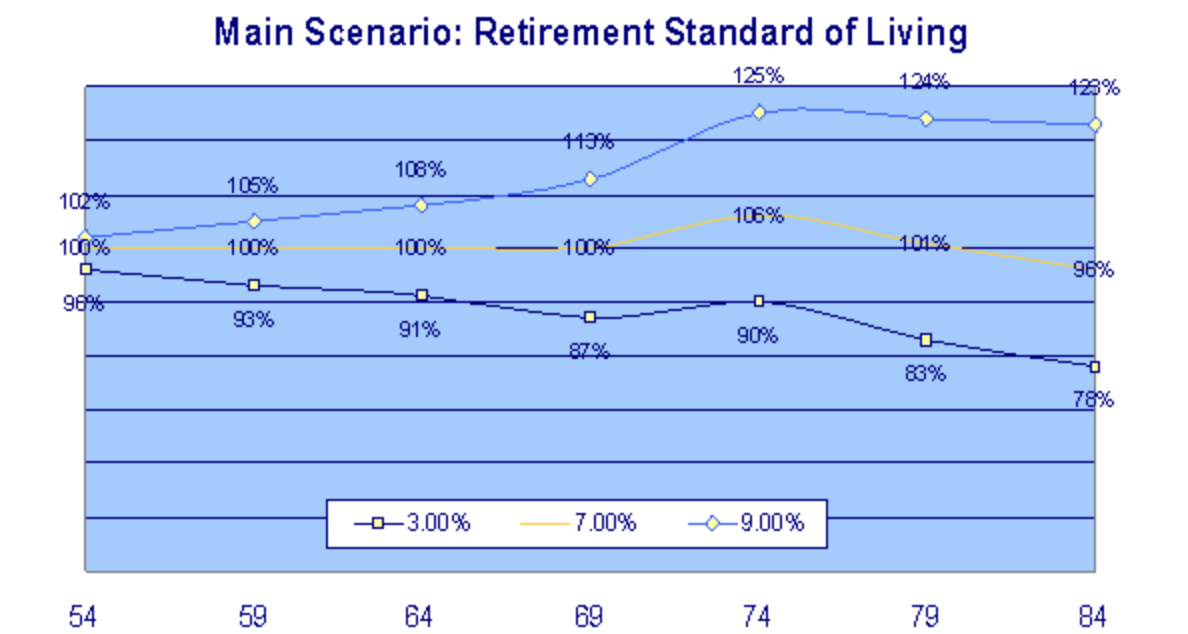

The real significance of these numbers only becomes apparent OVER TIME. The Standard of Living chart shows how your combined sources of retirement income (pension, investments, etc) hold up as a percentage of your pre-retirement salary. The chart reflects the natural tendency to adjust spending based on the value of your investments.